Cover

Mythbusters: KyCPA member survey

Issue 2

May 31, 2024

By Brittany McGill

KyCPA members benefits are continually evaluated to make sure the Society is meeting the needs of members. In the fall of 2023, more than 500 KyCPA members completed the latest member survey. Results of this survey help to reveal opportunities to better serve members and to grow as an organization. One opportunity is to combat some myths that some members may have regarding member benefits and services.

Questions

If you have any questions regarding member benefits, please reach out to Brittany McGill, Membership Director at bmcgill@kycpa.org. Thank you to everyone who took the time out of their day to complete the survey allowing us to better serve you, our members!

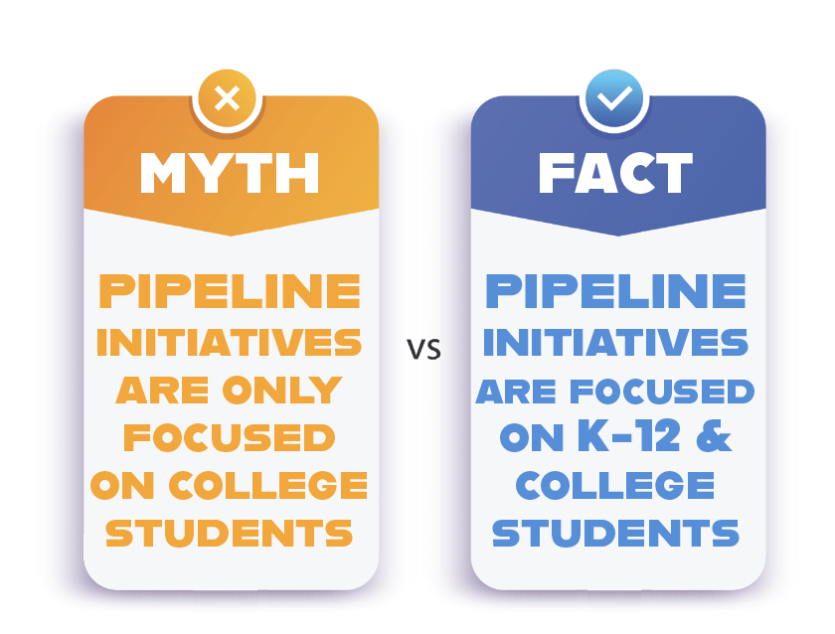

The Society works with several organizations in several ways to promote the CPA profession to help grow the pipeline.

Zoe Sapin, the Society's Student Membership Coordinator, attends events geared toward students K-12.

KyCPA hosts a FAB (Finance, Accounting and Business) Career Day for high school students interested in accounting, business and/or finance.

KyCPA participates in the AICPA’s Accounting Opportunities Experience, a month-long effort nationwide to get CPAs into high school classrooms to talk about the career opportunities in accounting.

The Educational Foundation financially invests in the Junior Achievement Western Kentucky program and NABA’s ACAP program. NABA’s ACAP program is a summer opportunity for minority high school students in Louisville to learn about the opportunities in the accounting profession.

We also participate on high school advisory boards in JCPS and work together with the Kentucky Department of Education to provide resources for teachers.

At the elementary school level, the Society has a storefront at Junior Achievement Biztown in Lexington, where 5th graders come in and run a simulated city, and have the opportunity to be the CPAs of the town and manage the finances! At the eighth grade level, KyCPA is represented at Junior Achievement's Inspire.

We are always looking for suggestions on ways we can engage with students of all ages throughout Kentucky to promote the CPA profession.

Email Zoe Sapin at zsapin@kycpa.org with suggestions and/or questions.

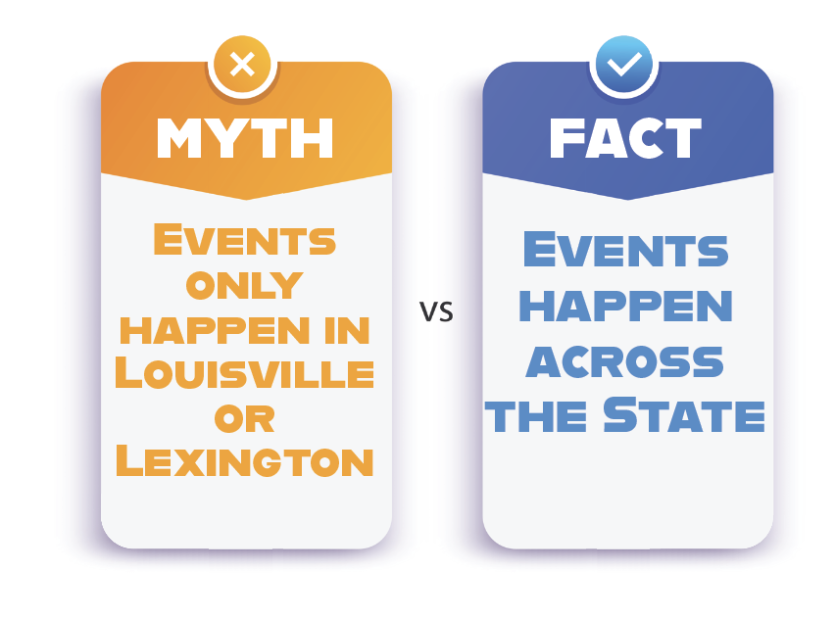

KyCPA has several events held outside of Louisville and Lexington.

This past January we held a Family Fun Day at Newport Aquarium. Join us for our upcoming Family Fun Day July 28 at the Beach Bend Amusement Park in Bowling Green. Click here for more information and to register.

In 2023 we had several networking events for KyCPA members. Locations included:

- Paducah

- Ashland

- Corbin

- Bowling Green

- Lexington

- Newport

In 2024 we are underway with additional networking events for KyCPA members; we visited Ashland on May 30 at The Mill for lunch. On June 26, join us for lunch at the Over/Under in Paducah and we will be in Covington on July 25 at Blinkers Tavern. Click here for more information and to R.S.V.P.

KyCPA will also hold our Professional Issues Updates at the following locations outside of Louisville later this year:

- Erlanger, September 24

- Paducah, October 30

- Ashland, November 12

We also have 2 opportunities to attend virtually or in Louisville on August 21 and November 14.

Click here to view details and to register for a Professional Issues Update.

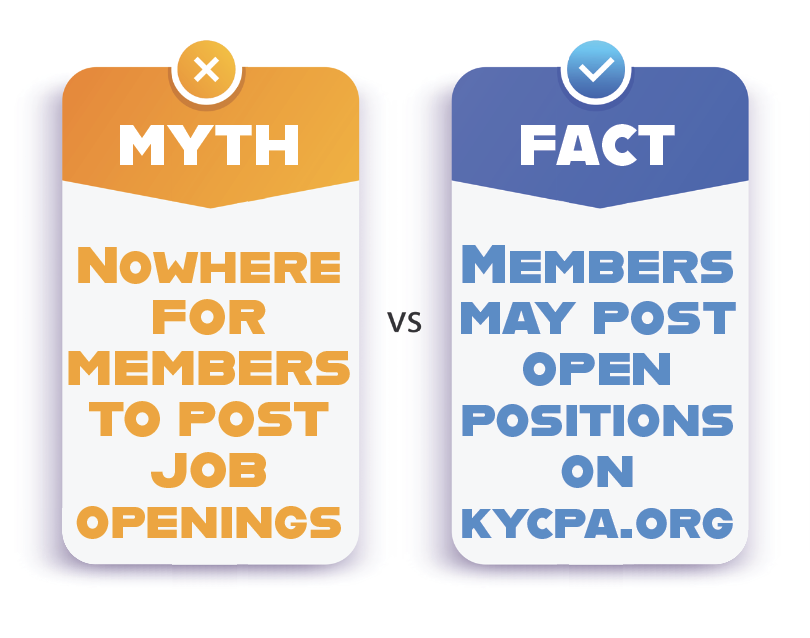

KyCPA has an employment resources page that includes a place for members to submit open accounting-related positions in Kentucky or surrounding areas. There is no cost for members to post an open position or internship. Click here to view or submit open positions.

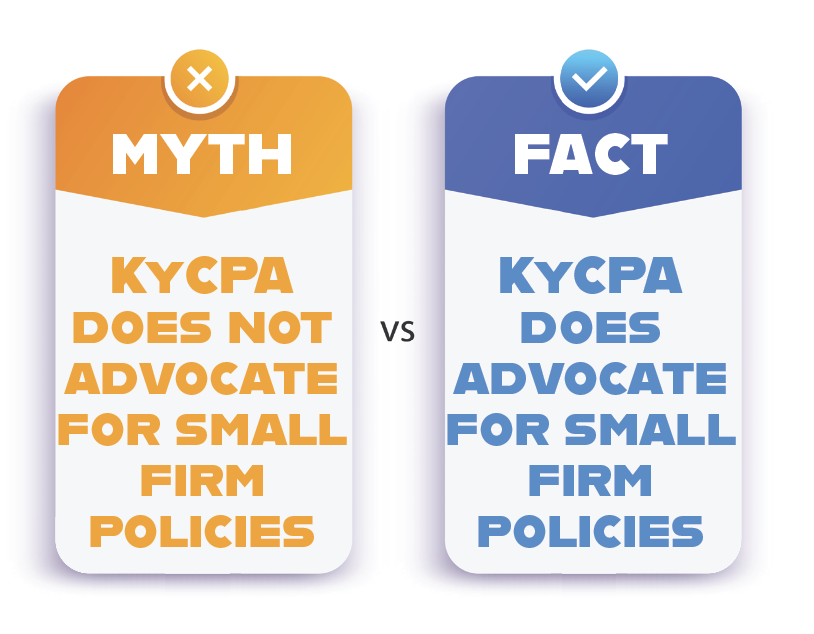

The Society's advocacy team focused on policy priorities that support our smaller firms by requiring the Department of Revenue publish administrative writings within 120 days of issuance or finalization, avoiding further expansion of Kentucky’s sales tax base to business-to-business services , and ensuring no retroactive tax laws were enacted. With multiple years of tax reform since 2020, the Society aimed to maintain tax policy consistency while guaranteeing key updates were adopted.

Click here to view updates and updates are emailed to members throughout the year as needed.

If you have any questions or comments, please contact KyCPA Government Affairs Director, Anthony Allen at aallen@kycpa.org.

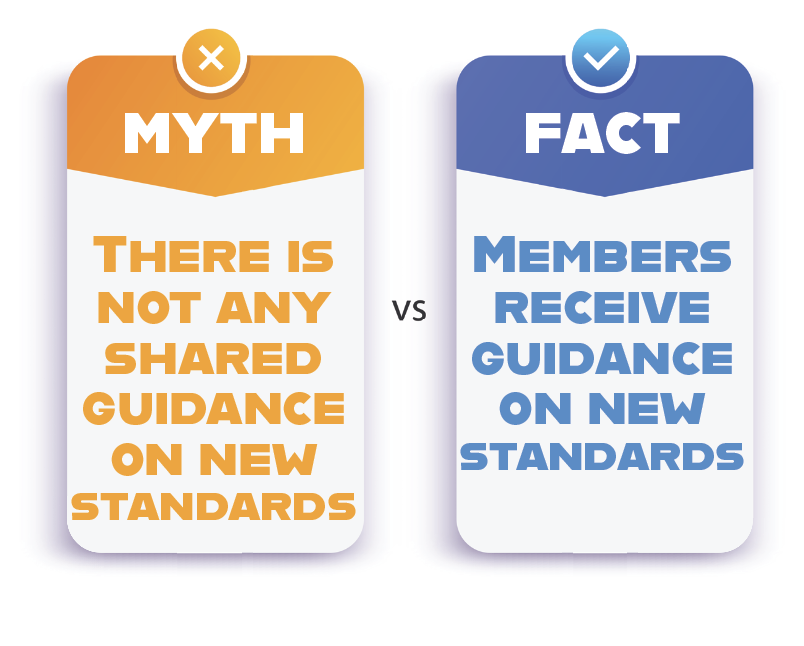

The Society's Tax Committee worked on a shared, comprehensive Kentucky pass-through entity guide and FAQ. KyCPA Government Affairs Director shared the information on Member Meetup on September 15, 2023 within the Open Forum Community. This guide was designed for all Kentucky practitioners to review and provide pooled expertise on the new complex law.

The Society's Tax Committee worked on a shared, comprehensive Kentucky pass-through entity guide and FAQ. KyCPA Government Affairs Director shared the information on Member Meetup on September 15, 2023 within the Open Forum Community. This guide was designed for all Kentucky practitioners to review and provide pooled expertise on the new complex law.

If you would like this FAQ, click here to login and download it from Member Meetup or email Anthony Allen at aallen@kycpa.org.

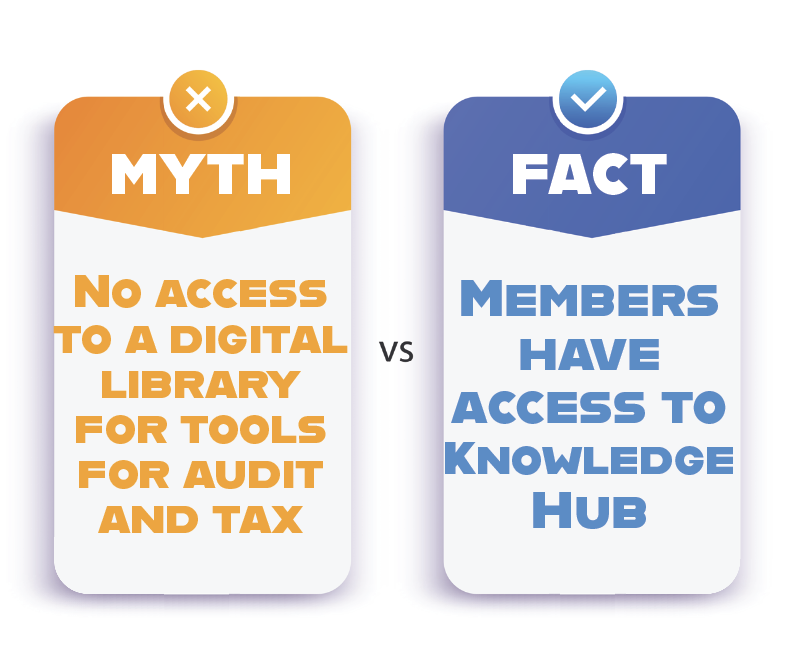

Knowledge Hub is a library of free downloadable content which includes white papers, webinars, product guides, case studies, industry analysis and much more. This information is provided by experts and vendors within the accounting industry and is especially helpful for small firms who cannot afford to buy all the resources.

Click here to search and download content from Knowledge Hub.

KyCPA members may receive 12 hours of free CPE each year! There are selected webcasts available for free each month.

Upcoming opportunities include:

- AICPA Town Hall Series:

- June 27

- July 18

- August 1

- AICPA A&A Focus:

- June 12

- July 10

- August 7

- Mind the gap: Managing scope & risk in client accounting services: October 29

Click here to view and register for all free CPE offerings.

We offered Saturday CPE in the past and had low registrations. There were a number of comments on the survey mentioning the need for CPE on Saturdays. Because of the feedback from the survey, KyCPA is offering Saturday classes again.

Click here to search all available Saturday courses.

If you have questions or need assistance contact the Society's Seminar Manager, Shari Stansbury at sstansbury@kycpa.org.

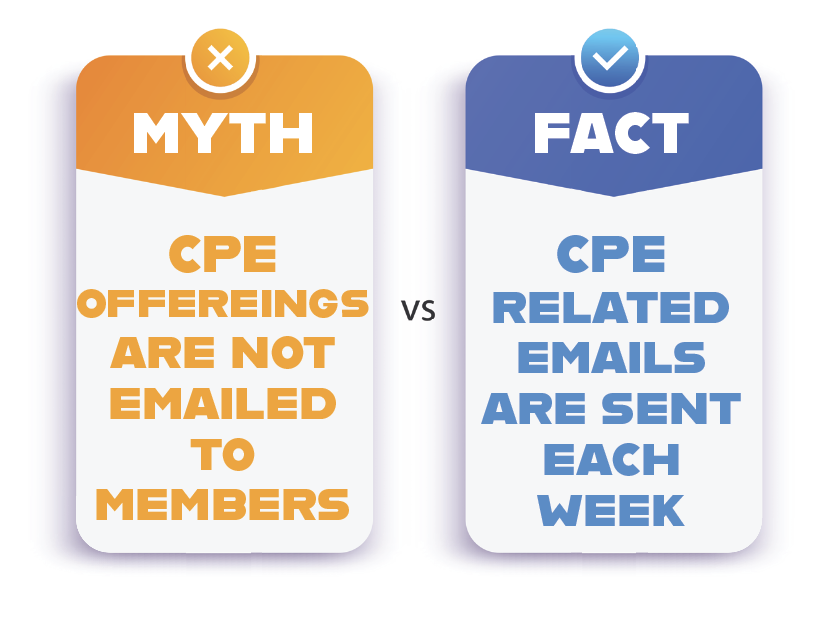

CPE Connection is emailed every Tuesday (April-January) and Wednesday Webinars get sent every Wednesday, year-round with highlighted webinars and/or on-demand courses in a variety of subject areas.

There is also a CPE section within the monthly e-newsletter that highlights upcoming seminars, conferences, CPE discounts and more.

If you are not receiving CPE related email communications, please check that they are not in your spam folder. If they are not in your spam folder, email cpe@kycpa.org and let us know you are not receiving the CPE related emails and would like to receive them.

You may also search the online CPE Catalog to find the CPE you need.

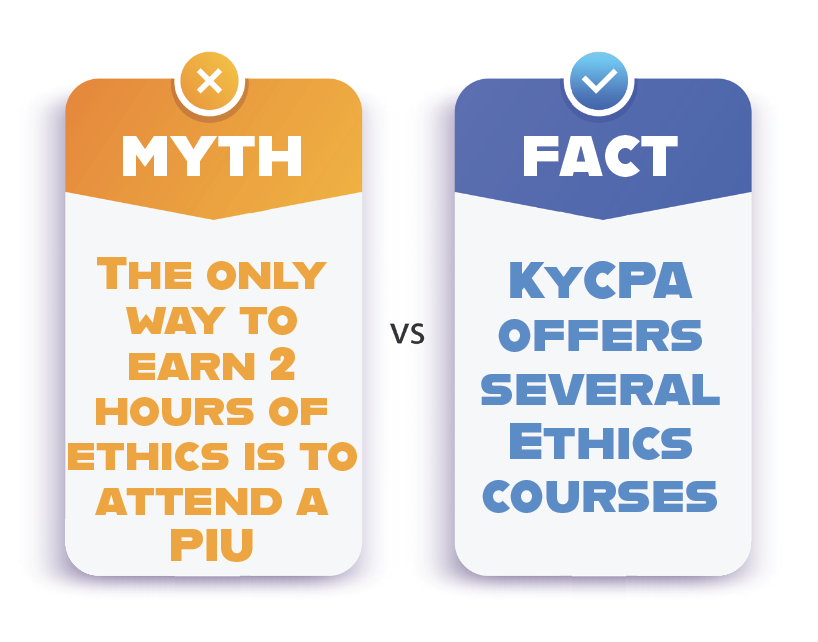

There are many courses that are available to earn your 2 hours of required ethics, including the Professional Issues Updates and select conferences have an ethics session.

Click here to view all available CPE that you can attend to earn the required ethics credits.

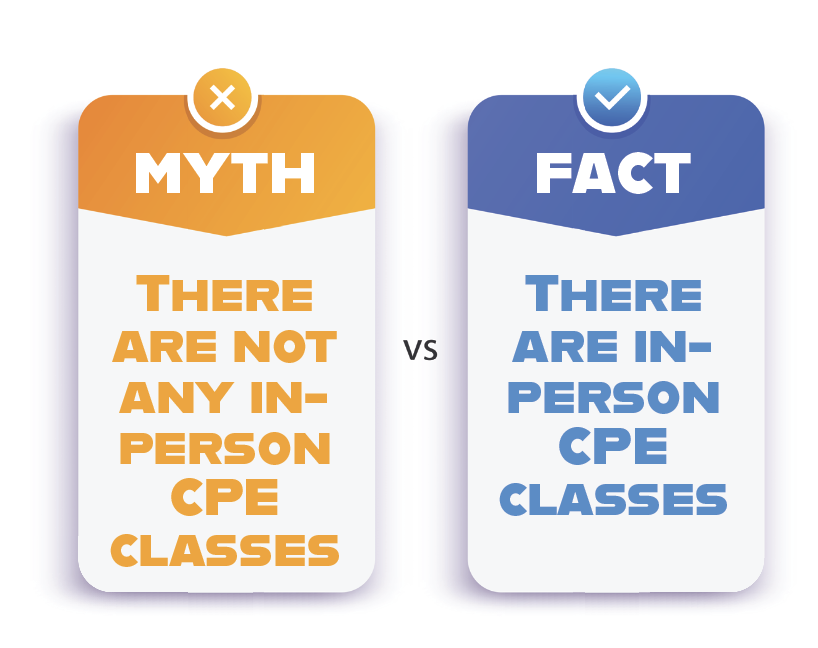

There are opportunities to attend CPE in-person. The following courses and conferences are available to attend in-person:

- Community Bank Update: July 19

- Summer Conference: July 21-25, Gulf Shores, AL

- Professional Issues and Ethics Updates:

- August 21, Louisville

- September 24, Erlanger

- October 30, Paducah

- November 12, Ashland

- November 14, Louisville

- Financial Institutions Conference: September 17

- CPAs in Business and Industry Conference: September 18-19

- Ohio Valley Construction Conference: October 24, Elizabeth, Indiana

- Commercial Real Estate Conference: November 20

- 2-Day Federal Tax Update:

- December 11-12

- January 6-7, 2025

- Kentucky State Tax Conference: December 18

There could be more in-person options, however, attendees vote with their registrations and virtual attendance is far more popular.

If you like attending in-person and want more opportunities, fill the seats of the courses and conferences that have an in-person option available.

Click here to register.

Questions

If you have any questions regarding member benefits, please reach out to Brittany McGill, Membership Director at bmcgill@kycpa.org.